Improve employee financial wellness and drive uptake of employee benefits through financial education and personalized, timely communications.

have reduced their financial stress

are confident in managing their finances

have a greater understanding of their benefits

Chat to our team to understand how financial wellbeing can support your employee workplace wellness programs.

300+ organizations across the world trust nudge

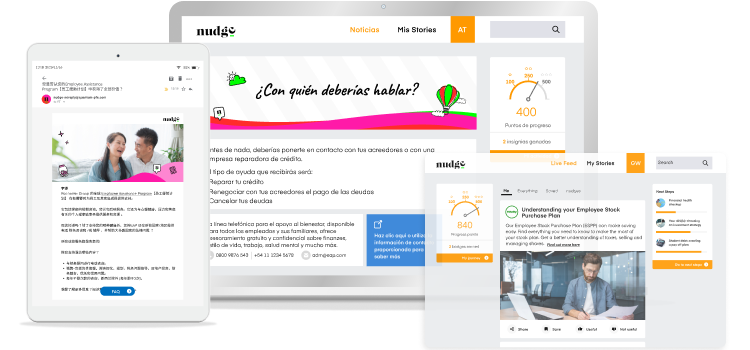

The nudge technology seamlessly integrates with popular benefit providers to drive awareness, understanding and uptake of all your benefits, from health insurance to retirement plans, wellness programs and much more. On nudge, you can segment and promote the right benefits to the right person, at the right time through trigger-based communications.

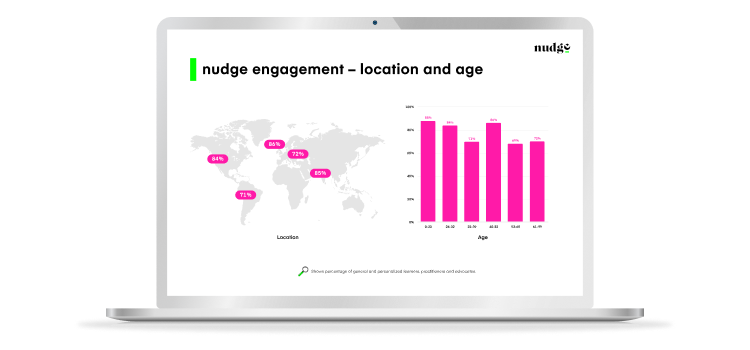

Access to critical data with nudgenomics (nudge’s analytics). Track engagement with nudge, employee financial health, needs and interests, benefit campaign engagement, and wider business impact. As well as enabling us to increase the impact of nudge, these insights will inform your wellness and employee benefit strategy, delivering programs your people really want, and need.

learn more

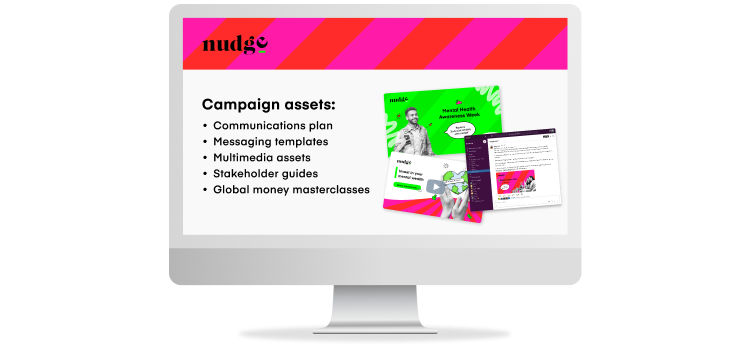

Our financial wellbeing calendar is created from over ten years of experience and insight into when financial wellbeing is needed the most throughout the year. Beyond a comprehensive launch plan, our calendar campaign toolkits are out-of-the box communications for your internal channels. Critical to driving awareness and engagement with nudge and your wider benefits, these campaigns motivate regular platform engagement throughout the year with improved outcomes.

Download 2024 calendar

Most companies have employee resource groups e.g. women’s or pride networks that are perfect to spread the good word about the benefits you offer. Our financial wellbeing champion training empowers groups to improve their financial wellbeing and signpost others to nudge to take action on theirs.

Download brochure

Something for everyone

Topics and mixed media content

Data driven personalization

Right content, to the right person, at right time

WCAG compliant

Highest accessibility standard

Community support

Targeted campaigns and masterclasses for employee resource groups

Global tech experience

Equitable support for all your locations

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

Read more FAQsnudge is an impartial, global financial education platform for all. Combining behavioural psychology, data and personalized education, nudge empowers people to develop their financial skills and knowledge. A global solution without conflicting financial products, our inclusive approach is trusted by millions worldwide.

The nudge platform helps you to better understand your finances, take action and plan your future. Key features include:

When it comes to financial education for all, our goal is to provide every individual with a consistent, personalized technology experience, with local financial education in local language. So, no matter where an individual is in the world, they receive personalized, localized and timely financial education.

With globally relevant financial education in 195 countries, nudge is the leading financial wellbeing provider. In 79 of these countries, users are enjoying financial and benefit education that is localized to their specific country. 40 countries are in local language, or languages where they are multilingual, e.g Canada (English and French), India (English and Hindi) and the U.S (English and Spanish).